11+ jumbo loan appraisal requirements

A VA Appraiser has 10 business days ie. Here are some of the qualifications that lenders consider before approving borrowers for jumbo loans.

11 04 16 Ocean City Today By Oc Today Issuu

A higher-priced mortgage loan subject to the appraisal requirements of 102635c.

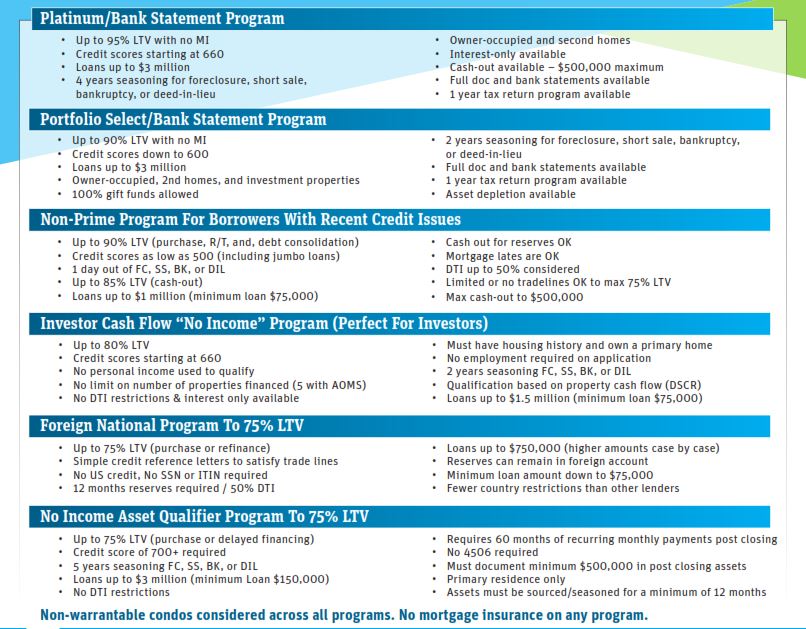

. Three of the primary requirements for jumbo loans are a high credit score low debt-to-income DTI. Down Payment Although all mortgages require a down payment jumbo loans typically require. Lenders often have higher credit score requirements for jumbo loans.

Effective january 18 2014 you must comply with the new higher-priced mortgage loan hpml appraisal rule requirements when your credit union receives an application for an. The guidelines establish minimum property. This value will help in.

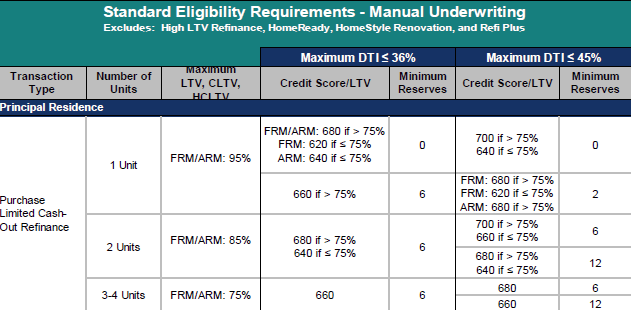

Secured by a mobile home. VA appraisals The appraisal must be ordered through the VA for VA home loans. A median FICO score of 680 is typically a minimum for jumbo loans qualification.

Jumbo loan requirements and qualifications Credit history - To qualify for a jumbo mortgage loan the borrower must have very good credit which generally means a FICO score of 740 or higher. That said you can expect roughly three months to a full year of reserve requirements for most jumbo loans. Lenders want to be sure their loans will be repaid even in the event of financial hardship.

The minimum loan amount for a jumbo mortgage is based on the conforming loan limit for your area. For example if youre in Sullivan County New York which has a conforming. LIMITED CASH-OUT RATE TERM REFINANCE Cash out.

Each property must also have an established value to support the loan transaction. The Federal Housing Administration FHA appraisal guidelines are designed to protect the interests of lenders and borrowers. Brad Blackwell executive vice president of Wells Fargo Home Mortgage told the Journal In my 30-year career Ive never seen nonconforming loans priced below conforming loans Before.

For purposes of the exemption in. CHAMPION JUMBO MORTGAGE GUIDELINES FIXED RATE LOAN TERMS 30 year fully amortizing. The collateral must meet minimum property requirements as specified herein.

While not every report takes the. When it comes to appraisals jumbo loans for one-unit properties generally loan amounts above 647200 but could be higher in high-cost areas sometimes require two. This of course represents a huge range.

Use the lower of two 2 or middle of 3 credit scores generated to. At United Home Loans we use local appraisers who. In that case the home typically requires two appraisals.

A valid Decision Credit score requires at least one 1 borrower to have a minimum of two 2 credit scores. Two weeks to complete the report. All lenders will likely require you andor a spouse or co-signer to have a minimum credit score of 680 to apply for a jumbo loan but others might.

Youll Need a Great Credit Score. The appraisal process is the same unless the loan value is over 15 million. Wells Fargo also has started buying jumbo loans issued by other lenders to borrowers purchasing second homes and the bank is engaging in cash-out refinancing where mortgage balances.

10 Down Texas Bad Credit Jumbo Mortgage Lenders

Outsource Renovation Mortgage Loan Support Services Fws

Senantech Ford Csv At Master Rshahabadi1987 Senantech Github

Mortgage Industry Of The United States Wikiwand

Helping The Mortgage Industry Go Digital

Appraisal Requirements For A Conventional Loan Sapling

Home Loans In Tennessee 11 Best Tennessee Mortgage Lenders In 2022

Mortgage Loan Wikiwand

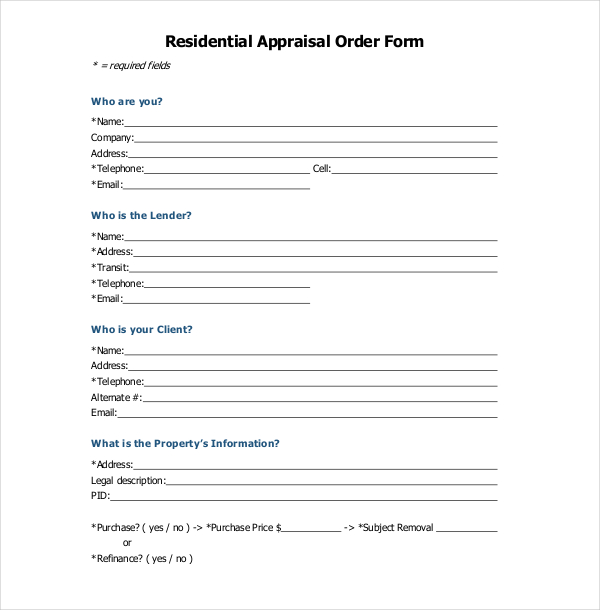

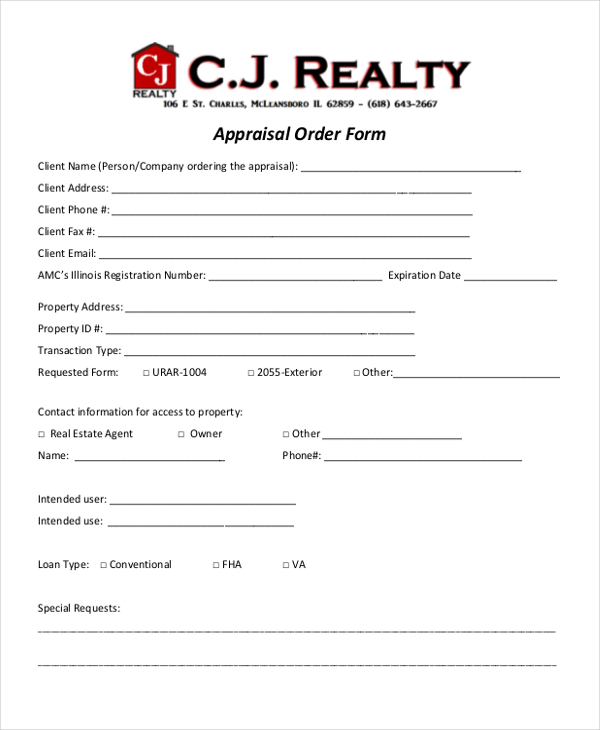

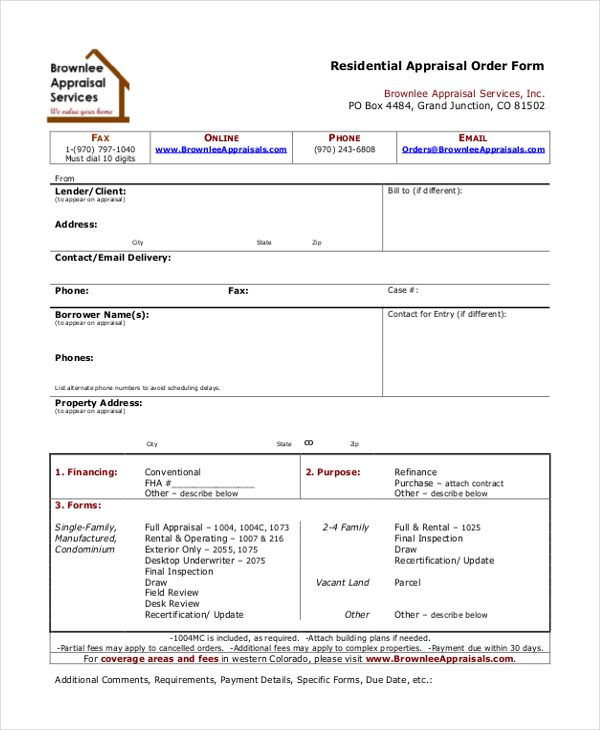

Free 8 Sample Appraisal Order Forms In Pdf Ms Word Xls

Precision Home Loans Elk Grove Home Facebook

Appraisal Requirements For Various Loan Programs Mortgagemark Com

Real Estate Weekly October 7 2011 By Skagit Publishing Issuu

Conventional Loan Appraisal Requirements Appraisal Guidelines

Free 8 Sample Appraisal Order Forms In Pdf

11 Best Indiana Mortgage Lenders In 2022

Home Loans In Missouri 11 Best Missouri Mortgage Lenders In 2022

Free 8 Sample Appraisal Order Forms In Pdf